IBM's Financial Wellness Companion

Discover how IBM's innovative personal automated credit scoring and support system, designed for ABN Amro bank, ensures quick, efficient, and fair loan processing, especially benefiting financially illiterate or impulsive users.

Duration

Sep 2022 - Nov 2022

Client

IBM | TU Delft

Project Nature

Team Project

Role

Roadmap Designer

Future Vision

Providing people with little access to personal loans, an equal chance based on their own merits. Guiding people to a better financial future through education and protection

Hyperpersonalization

Striving for Equality

Need for financial literacy

In response to the evolving financial landscape and societal demands, our concept envisions a future where personal loans are accessible to all, fostering equality and empowering individuals based on their merits. Guided by the principles of fairness and explainability—integral to IBM's trustworthy AI framework—we aim to provide customers with a transparent and unbiased loan process. Trends in societal equality, hyper-personalization, and the imperative need for financial literacy underscore the relevance and timeliness of our concept. ABN Amro's commitment to being a future-proof bank aligns seamlessly with our vision, emphasizing the importance of customer experience.

IBM’s Financial Wellness Companion for ABN Amro

The innovative IBM-designed personal automated credit scoring and support system for ABN Amro redefines the loan process, emphasizing accessibility, efficiency, and fairness. Divided into two crucial components, the system seamlessly guides users through the Personal Loan Application and Post Loan Support phases, ensuring a holistic and supportive financial experience.

Personal Loan Application

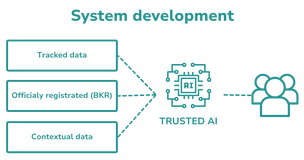

In this initial phase, users initiate the process by inputting desired loan details and personal information. Leveraging a wealth of data, including personality traits, financial history, and economic context from sources like Google, metadata, and bank statements, the AI generates an optimized loan proposal. This proposal is accompanied by a comprehensive personal repayment report, providing users with transparent insights into the AI's decision-making process. By prioritizing explainability and fairness, ABN Amro aims to empower users, especially those with financial literacy challenges, to make informed decisions about their loans.

Post Loan Support

Once the loan is granted, the system seamlessly transitions into the Post Loan Support phase. The AI-driven system keeps track of repayment schedules, provides personalized plans and issues warnings for potential financial pitfalls. The educational aspect of the system comes to the forefront as it analyzes user spending behaviour, financial status, and economic context to formulate personalized repayment strategies. The warning system intervenes if users deviate from the plan, while fierce guidance is activated when potential debt is predicted. This proactive approach ensures that users receive financial support and are equipped to navigate future financial challenges.

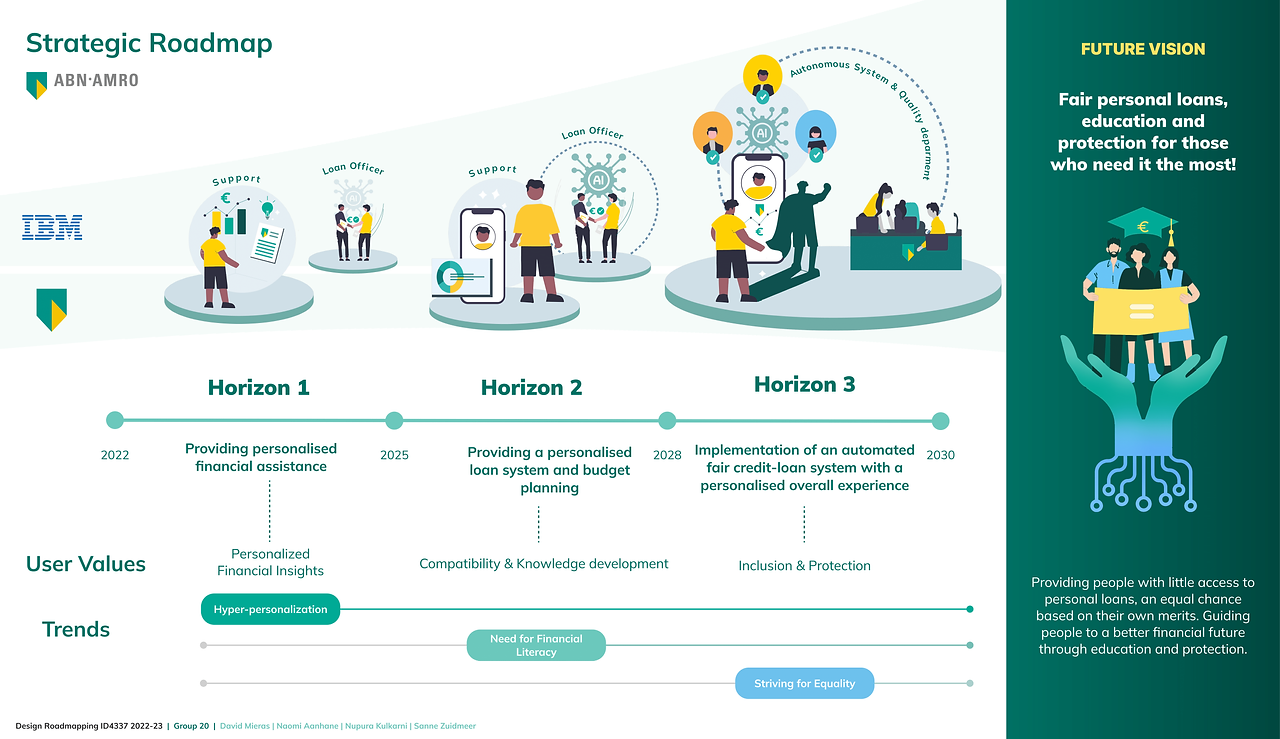

STRATEGIC ROADMAP

Horizon 1 - Building Personalized Foundations

In the initial horizon, the primary focus is on establishing the groundwork for the Financial Wellness Companion. The value proposition centers around providing personalized financial assistance, aiming to create a seamless user experience. The objective is to design a robust data policy and build the initial model. Users benefit from a personalized approach, and the loan officer operates independently from the AI. This phase involves setting policies for tracking and storing data from various sources.

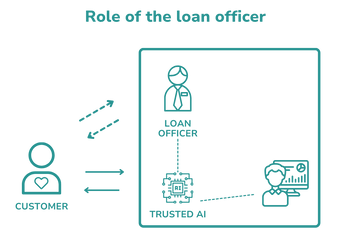

Horizon 2 - Enhancing User Engagement

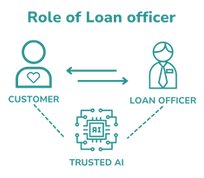

Moving into the second horizon, the goal is to enhance user engagement by providing a personalized loan system and budget planning. The value proposition extends to offer a more interactive and supportive experience. The objective shifts to studying customer-system interaction, ensuring compatibility and fostering knowledge development. In this stage, direct contact between customers and loan officers is emphasized. The AI system supports loan officers by providing proposals and insights, while also monitoring customer behavior for continuous feedback.

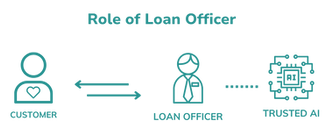

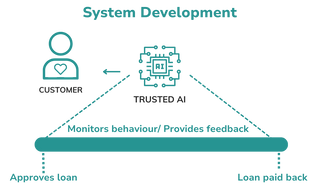

Horizon 3 - Implementing Autonomous Fairness

In the final horizon, the focus shifts towards the full implementation of an automated fair credit-loan system with a personalized overall experience. The value proposition encompasses delivering a long-term viable product. Objectives include creating an autonomous AI system that provides personalized loan proposals, with loan officers monitoring for quality and ensuring equal policies. Users benefit from inclusion and protection, and IBM developers receive continuous feedback to update and refine the system for optimal performance.

VALUE TENSIONS

Navigating ethical considerations, our concept addresses key value tensions in data collection, decision-making, and fierce guidance to ensure a responsible and efficient AI-driven loan system.

Privacy vs. Efficiency

Balancing user privacy concerns with model efficiency, we prioritize utilitarian ethics, justifying data collection for significant user benefits in an efficient loan experience.

Augmentation vs. Automation

Choosing between augmenting the loan officer's role and full automation, we emphasize efficiency gains through automation, mitigated by human oversight for user protection.

Autonomy vs. Efficiency

In post-loan support, balancing user autonomy and system efficiency, we advocate for a virtuous approach, combining fierce guidance with a human touch for user protection and system efficiency.

During the 10-week Design Roadmapping course, our team of four strategic product designers collaborated on a project for IBM, focused on envisioning the future values, business models, and service features for trusted AI in banking. My contribution involved taking on the responsibility of technology scouting and designing the tactical roadmap. I conducted thorough research on AI and machine learning tools, exploring their potential applications and limitations, and addressed value tensions in their implementation. In a domain new to our team, each member delved into individual studies, and together, we worked seamlessly on all aspects of the project. My role included leadership and task planning, ensuring a collaborative and comprehensive approach to the project.

Special thanks to

Team

David Mieras, Naomi Aanhane

and Sanne Zuidmeer

Coaches

Lianne Simonse

Tools used in the project